Bitcoin Solutions

by Christopher Westra

How to Understand the Importance of Bitcoin by Exploring Specific Problems for Which Bitcoin Provides a Solution

This site is underway, feel free to explore below. You can also check out my other websites:

Bitcoin Poems (All Bitcoin Poems by Christopher)

The Bitcoin Effect (How Bitcoin Changes You)

Prosperity Poems (Over 100 Prosperity Poems by Christopher)

Add your email below to receive each new Bitcoin Solution as it's written! Learn about sound money and how it can transform your life.

Table of Contents

Jungle Tokens vs. Sun Circles: The Orangutans Find Financial Freedom

Weaving a Brighter Future: A Meerkat Tale of Financial Freedom

Frozen Funds, Fierce Spirit: Lily's Fight for Freedom with Bitcoin

“Don't Trust, Verify”: A Whisper that Revolutionized the Animal Kingdom

Captain Satoshi's Seashell Solution: Bringing Trust to Digital Transactions

Captain Satoshi's Seashell Solution: Bringing Trust to Digital Transactions

Anika's Tapestry and the Threads of Innovation: A Story of Bitcoin's Impact

Beyond the Tallykeeper's Reach: A Free Market Triumph in the Valley

The Minters and the Programmers: A Tale of Two Currencies

Oakhaven's Golden Goose: A Fable About Inflation and Opportunity

The Echoes of War: A Cautionary Tale of Inflation and Conflict

From Opaque to Open: How Honeycomb Creek Found Security in Transparency

The Shards of Hope: A Kingdom's Journey from Inflation to Equity

From Shifting Sands to Solid Ground: How a Village Gained Surety

The Weight of Gold vs. the Speed of Light: A Marketplace Transformed by Digital Currency

Beyond the Siren's Song: Bitcoin and the Fight Against Monetary Manipulation

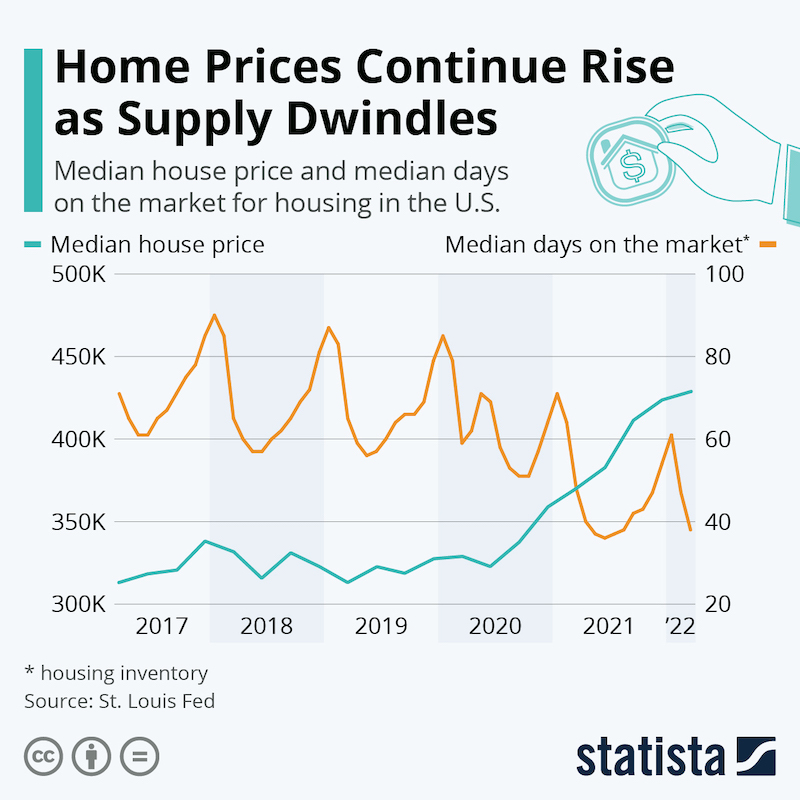

Problem 17 - Home Affordability

A Fortress Against Inflation: The Star Anchor and the Dream of Home Ownership

Bitcoin to the Rescue: A Story of a Dentist Who Outwitted Inflation

Cracks in the Golden Chest: A Story of Broken Power and the Promise of Bitcoin

From Pebbles to Profits: A Playground Lesson in Economics

The Sandglass of Trust: A Tale of Peer to Peer Innovation in the Crimson Citadel

Evergold's Shadow: A Tale of Short-Term Thinking and the Bitcoin Revolution

Shiny Objects vs. the Golden Strategy: Lily and Max's Journey

The Curse of Plenty: A Story of Inflation and the Search for a Scarce Solution

Nighttime Grind: The Water Wheels that Saved the Day (and the Flour)

The Problems and Solutions Poems

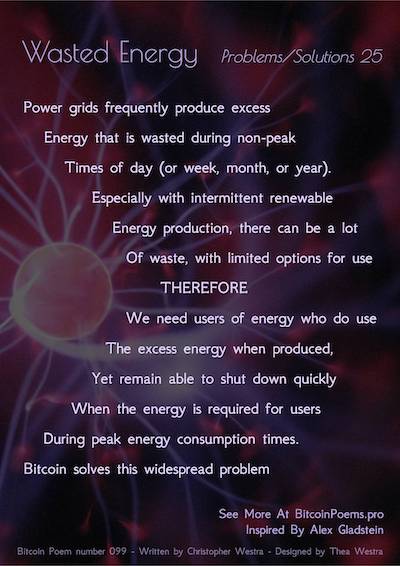

Some of my Bitcoin Poems include my Problems and Solutions Series. These are written in specific format to help me succinctly describe a problem of fiat money and how Bitcoin fixes that problem.

I’ll list these here with links to the poems with a background. But I’ll add just the wording here. Each poem is in the shape of an arrow, with the first part describing the problem, and the last part describing the solution, with the center being a hinge point.

People and nations around the world experience these problems at different levels. For example, some nations experience horrific inflation that impacts their life at a deep level, and some wealthy people in countries with lower inflation may not feel the effects much. But each of these problems affects billions of people.

As you might expect, in nations that experience more of these problems, Bitcoin interest and adoption is much higher! In nations where censorship is not widely practiced yet, and financial systems are working somewhat smoothly, and inflation isn’t rampant, many people can’t see as much need or use for Bitcoin.

When Bitcoin solves a problem for three billion people, and you are one of the five billion who don’t experience that particular problem, you can’t say that Bitcoin isn’t a solution that is helping. That’s simply shortsighted and provincial..!

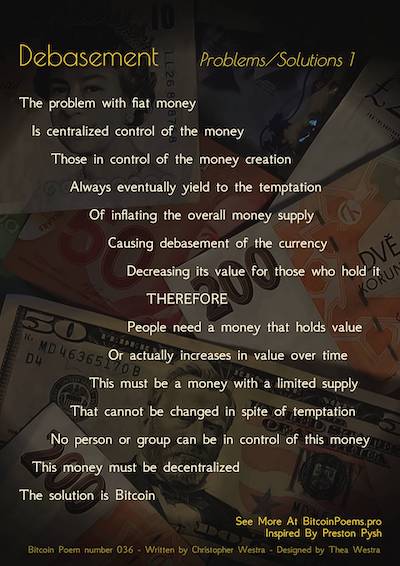

Problems and Solutions 1 - Debasement

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 1 Poem (Debasement) is Bitcoin Poem 036 – and was inspired by Preston Pysh

The problem with fiat money

Is centralized control of the money

Those in control of the money creation

Always eventually yield to the temptation

Of inflating the overall money supply

Causing debasement of the currency

Decreasing its value for those who hold it

Therefore

People need a money that holds value

Or actually increases in value over time

This must be a money with a limited supply

That cannot be changed in spite of temptation

No person or group can be in control

This money must be decentralized

The solution is Bitcoin

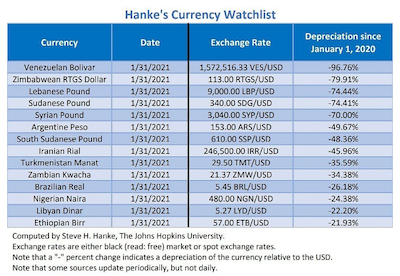

Here is a screenshot taken from Cato.org that shows the debasement of some currencies between January 1, 2020 and January 31, 2021, a little over a year.

Source for the above chart - Cato.org.

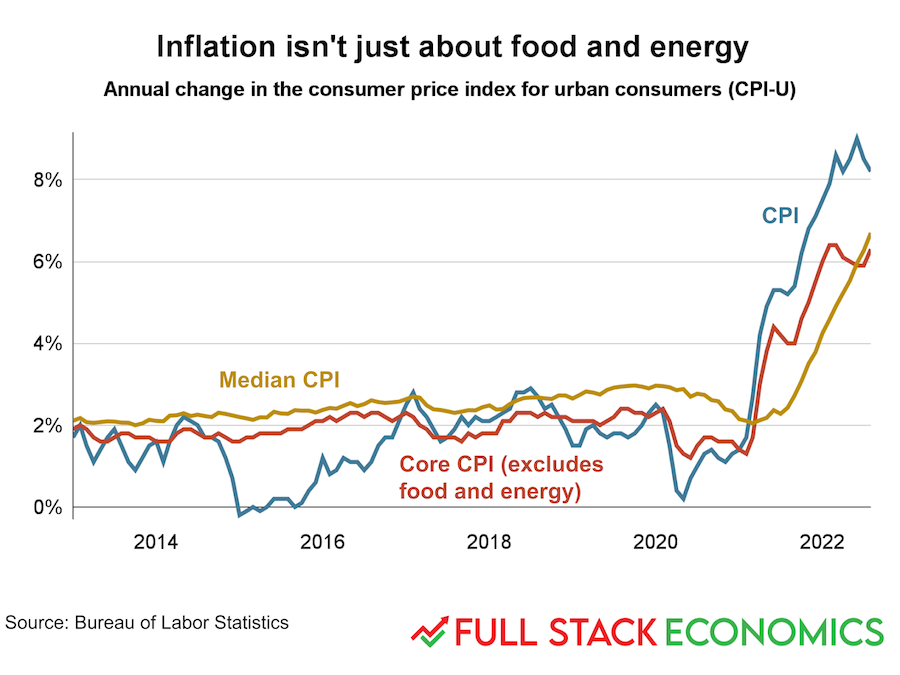

Note that the depreciation is measured against the US Dollar, which is also depreciating! So the actual fall in value is even worse than what is pictured here. Problem number 1 (Debasement of the money supply) is at the root of many of the other problems.

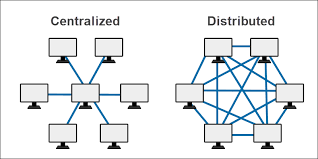

Bitcoin addresses the issue of debasement of the money supply with fiat government currency units through its decentralized and deflationary nature. Unlike traditional fiat currencies that are subject to central bank control and government policies, Bitcoin operates on a decentralized network of nodes.

This means that no single entity, government, or institution has control over the issuance or manipulation of Bitcoin. The total supply of Bitcoin is capped at 21 million, making it immune to the inflationary pressures often associated with fiat currencies.

The decentralized nature of Bitcoin ensures that no central authority can arbitrarily increase the supply of Bitcoin, preventing the debasement of its value through inflation. In contrast, central banks have the power to print more money, leading to an increase in the money supply and, consequently, inflation.

Bitcoin's fixed supply fosters confidence among its users, as they are assured that their holdings won't be eroded over time due to inflation caused by unchecked money printing.

Moreover, the transparent and immutable nature of the Bitcoin blockchain provides a clear and verifiable record of all transactions. This transparency reduces the likelihood of corruption and manipulation in the financial system.

Bitcoin's decentralized and borderless nature also makes it resistant to geopolitical influences that can impact traditional currencies. This resilience further protects it from debasement caused by political or economic instability in any particular region.

In summary, Bitcoin's decentralization, fixed supply, transparency, and resistance to geopolitical influences collectively contribute to solving the problem of debasement in the money supply associated with fiat government currency units.

It offers a reliable alternative for individuals seeking a store of value that is not subject to the whims of centralized authorities and the risks of inflation.

Here is a story to illustrate.

Jungle Tokens vs. Sun Circles: The Orangutans Find Financial Freedom

In the heart of the whispering jungle, resided a troop of wise old Orangutans. They were the keepers of knowledge, their memories stretching back generations. Their greatest treasure, however, wasn't fruit or shiny stones, but a collection of colorful leaves called “Jungle Tokens.”

These tokens, once plentiful, represented the value of everything from woven vines to juicy mangoes. But lately, the Orangutans noticed something unsettling. The Great Monkey, the ruler who controlled the token printers, kept adding more and more leaves to the pile.

“More tokens for everyone!” the Great Monkey declared with a booming voice. But the Orangutans weren't fooled. The extra leaves diluted the value of the ones they already had. A single token, once enough for a basket of mangoes, could barely buy a single fruit. The elders worried, their once-comfortable lives becoming a struggle.

One day, a young, adventurous Gibbon swung into their clearing. He spoke of a revolutionary system called “Sun Circles,” a digital currency independent of any central authority. Intrigued, the Orangutans gathered around.

“Imagine,” the Gibbon chirped, “a system where no single monkey controls the money supply. Sun Circles are like fireflies in the night – limited in number and forever visible on a vast, glowing web.”

The Orangutan elders' eyes gleamed. “Limited numbers? No more inflation?”

The Gibbon nodded. “Sun Circles can't be printed at will. There's a finite number, ensuring their value remains strong. It's like the rarest, most precious fruit in the jungle, its worth never diminishing.”

Hope flickered in the Orangutans' wise eyes. With Sun Circles, their hard-earned tokens wouldn't lose value overnight. They could plan for the future, knowing their savings would retain their purchasing power.

News of Sun Circles spread through the jungle like wildfire. Soon, all the animals, from the lumbering Elephants to the scurrying Squirrels, were using them. The Great Monkey, threatened by the loss of his control, fumed and raged. But the tide had turned. The creatures of the jungle craved a system fair and transparent, one that protected their hard work.

Sun Circles, though new and unfamiliar, offered a beacon of stability. They promised a future where value wasn't dictated by a single ruler, but secured by a system beyond manipulation. And so, the Orangutans, with their wisdom and foresight, helped lead the jungle into a new era of financial freedom.

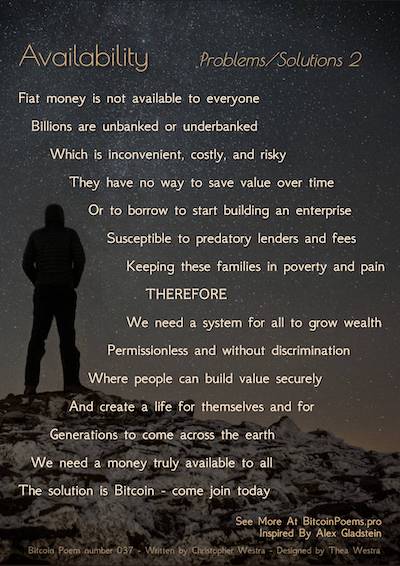

Problems and Solutions 2 - Availability

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 2 Poem (Availability) is Bitcoin Poem 037 – and was inspired by Alex Gladstein

Fiat money is not available to everyone

Billions are unbanked or underbanked

Which is inconvenient, costly, and risky

They have no way to save value over time

Or to borrow to start building an enterprise

Susceptible to predatory lenders and fees

Keeping these families in poverty and pain

Therefore

We need a system for all to grow wealth

Permissionless and without discrimination

Where people can build value securely

And create a life for themselves and for

Generations to come across the earth

We need a money truly available to all

The solution is Bitcoin - come join today

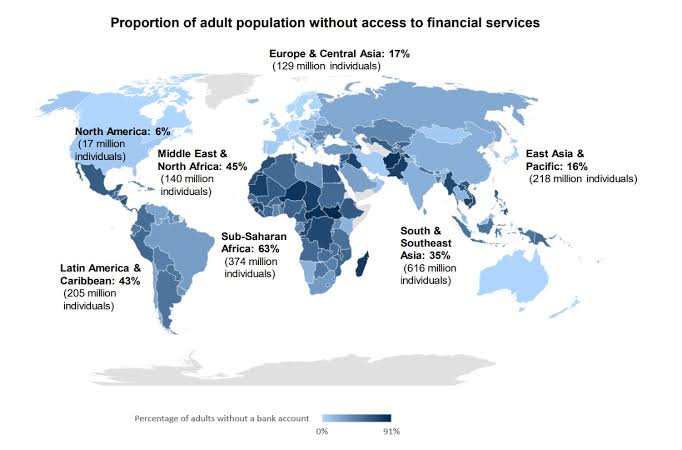

According to the World Bank, around 1.4 billion adults worldwide are unbanked. This is close to one-fourth of the world's population.

See the image below to see which countries have more people using banking services, and which have largely unbanked populations.

Bitcoin plays a crucial role in addressing the issue of financial inclusion by providing a decentralized and accessible financial system for the unbanked population around the world. A significant proportion of the global population, often referred to as the “unbanked,” lacks access to traditional banking services due to various reasons, such as living in remote areas, lacking proper identification, or facing exclusion based on economic status.

Bitcoin's decentralized nature allows individuals to participate in the global economy without the need for traditional banking infrastructure.

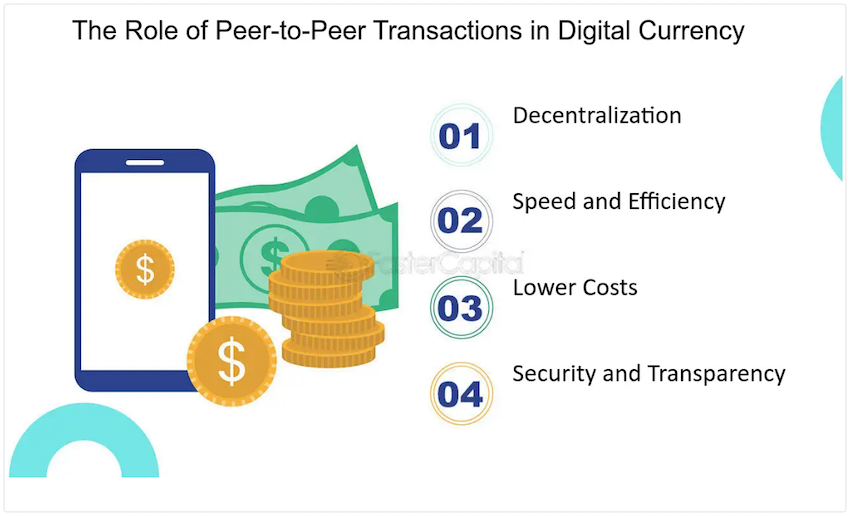

First, Bitcoin operates on a peer-to-peer network, enabling direct transactions between users without the need for intermediaries like banks. This eliminates the barriers that traditional banking systems impose, making financial services more readily available to those without access to traditional banks.

Anyone with an internet connection and a digital wallet can participate in the Bitcoin network, providing financial inclusion to the unbanked population.

Second, Bitcoin serves as a store of value and a means of transferring value across borders. In regions where traditional banking infrastructure is limited or nonexistent, individuals can use Bitcoin as a secure and efficient alternative for storing and transferring wealth. This is particularly impactful in areas where people face currency volatility, high inflation, or political instability, providing a more reliable and accessible financial option.

Third, the permissionless nature of Bitcoin allows individuals to create and manage their own digital wallets without relying on approval from financial institutions. This is particularly empowering for those who lack access to formal identification or credit history, as Bitcoin transactions are based on cryptographic keys rather than personal information.

Bitcoin's decentralized, borderless, and permissionless characteristics make it a powerful tool for promoting financial inclusion. It provides the unbanked population with access to a global financial system, allowing them to store value, engage in peer-to-peer transactions, and participate in economic activities without relying on traditional banking infrastructure.

This has the potential to uplift millions of individuals who have been excluded from the formal financial system, fostering economic empowerment and financial autonomy.

Here is a story to illustrate.

Weaving a Brighter Future: A Meerkat Tale of Financial Freedom

In the bustling animal market of Savannaborough, resided a family of meerkats – Papa Meerkat, Mama Meerkat, and their five energetic pups. They were skilled weavers, crafting baskets coveted by all creatures. Yet, their joy was dampened by the lack of a burrow bank.

The grand Savannah National Bank, run by the snooty Lion family, had a burrow door that remained firmly shut to the meerkats. They lacked the “proper paperwork,” a fancy term that left Papa Meerkat scratching his head. Without a burrow bank, the meerkats couldn't save their earnings or borrow to expand their weaving business.

Loan sharks, like the sly Hyena clan, lurked in the shadows, offering money at exorbitant rates. One bad deal and the meerkats could lose everything. Their woven dreams of a bigger burrow and a brighter future seemed to slip away with each passing sandstorm.

One day, a traveling Fennec Fox arrived, his fur shimmering with an otherworldly glow. He spoke of a revolutionary system called “Sunstones,” a digital currency independent of any burrow bank. Intrigued, the meerkats gathered around.

The Fennec Fox explained, “Sunstones are like shiny pebbles you can't hold, but everyone can see them on a special ledger. You can trade them with anyone, anywhere, without needing a fancy burrow bank or permission from grumpy lions.”

Mama Meerkat's eyes sparkled. “This means we can save our basket earnings as Sunstones, safe from hyenas!”

The Fennec Fox smiled. “Not just that! With Sunstones, you can borrow from others without outrageous interest rates. You can even use them to buy supplies from faraway markets!”

Papa Meerkat tilted his head. “But how do we get these Sunstones?”

The Fennec Fox winked. “All you need is a little burrow called a 'digital wallet' and an internet connection. It's open to everyone, meerkats, elephants, anyone!”

Hope bloomed in the meerkat family. With Sunstones, they could finally build their dream burrow, expand their business, and leave behind the clutches of loan sharks. The future, once shrouded in sand, shimmered with possibility.

News of Sunstones spread like wildfire throughout Savannaborough. Slowly, but surely, animals of all shapes and sizes began using them. The cheetahs, known for their lightning-fast deliveries, used Sunstones for secure, borderless transactions. The wise old owls, with their limited mobility, could now manage their savings digitally.

The Savannah National Bank, however, watched with suspicion. Their monopoly on burrows seemed threatened. But the tide had turned. The animals of Savannaborough craved a financial system that was fair, accessible, and built for everyone.

Sunstones, though a new concept, offered a beacon of hope, a chance for every creature to weave their own path to prosperity. The story of the meerkats became a legend, a reminder that even the smallest creatures could dream big and build a brighter future with a financial system that belonged to all.

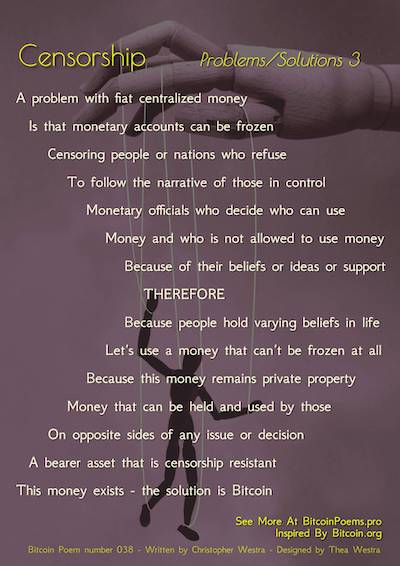

Problems and Solutions 3 - Censorship

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 3 Poem (Censorship) is Bitcoin Poem 038 – and was inspired by Bitcoin.org

A problem with fiat centralized money

Is that monetary accounts can be frozen

Censoring people or nations who refuse

To follow the narrative of those in control

Monetary officials who decide who can use

Money and who is not allowed to use money

Because of their beliefs or ideas or support

Therefore

Because people hold varying beliefs in life

Let’s use a money that can’t be frozen at all

Because this money remains private property

Money that can be held and used by those

On opposite sides of any issue or decision

A bearer asset that is censorship resistant

This money exists - the solution is Bitcoin

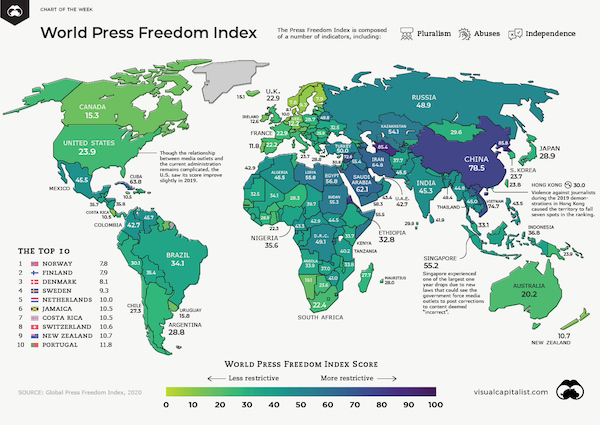

See the image below for some indication of press freedom vs. censorship in countries. I do believe more countries are moving toward censorship. This image is from VisualCapitalist.com.

Bitcoin acts as a powerful tool against financial censorship by providing individuals with a censorship-resistant means of transacting and storing value. In various instances, governments or financial institutions may freeze assets or restrict financial transactions to enforce a particular narrative or political agenda.

Bitcoin, being decentralized and borderless, allows users to maintain control over their funds without the risk of censorship.

First, The decentralized nature of the Bitcoin network ensures that there is no single point of control or authority. Traditional financial systems often rely on centralized entities such as banks or governments, which can be influenced or coerced to freeze assets or block transactions. Bitcoin, on the other hand, operates on a peer-to-peer network of nodes globally, making it resistant to censorship attempts.

No central authority has the power to arbitrarily freeze or confiscate Bitcoin funds, providing individuals with financial autonomy.

Second, Bitcoin transactions are pseudonymous, meaning that users can conduct financial transactions without revealing their identities. This anonymity protects individuals from potential repercussions or censorship based on their beliefs, activities, or political affiliations. While the blockchain records all transactions, the identities of users are not directly tied to their wallet addresses, adding a layer of privacy that is absent in traditional financial systems.

Third, Bitcoin's borderless nature enables individuals to conduct transactions across international boundaries without being subject to the financial regulations of any specific jurisdiction. This is particularly important for those living in regions with oppressive regimes or where financial censorship is prevalent. Users can send and receive Bitcoin globally, bypassing restrictions imposed by local authorities and preserving their financial freedom.

Bitcoin provides a decentralized, pseudonymous, and borderless alternative to traditional financial systems, making it resistant to censorship. Users can transact and store value without fear of asset freezing or transaction blocking based on political or ideological reasons.

This empowers individuals to exercise their financial freedoms without being subject to the control of centralized entities, fostering a more open and censorship-resistant financial ecosystem.

Here is a story to illustrate.

Frozen Funds, Fierce Spirit: Lily's Fight for Freedom with Bitcoin

In the heart of a bustling city, there lived a young woman named Lily. Lily was a passionate advocate for free speech and individual rights, often speaking out against injustices and oppression. But her outspokenness had drawn the attention of powerful forces who sought to silence her.

One fateful day, Lily woke up to find her bank account frozen, her assets seized by those who disagreed with her beliefs. Shocked and dismayed, she realized the extent of financial censorship that could be wielded against those who dared to challenge the status quo.

Determined not to be silenced, Lily sought refuge in the world of Bitcoin. With its decentralized and censorship-resistant nature, Bitcoin offered her a lifeline in the face of adversity.

No longer beholden to centralized financial institutions, Lily took control of her financial destiny, embracing Bitcoin as a tool for empowerment and liberation. With Bitcoin, she could transact freely, without fear of censorship or reprisal.

As she delved deeper into the world of Bitcoin, Lily discovered a community of like-minded individuals who shared her values and beliefs. Together, they championed the cause of financial freedom, spreading the message of Bitcoin far and wide.

In the face of growing censorship and oppression, Bitcoin emerged as a beacon of hope for those who sought to challenge the status quo. Its decentralized and borderless nature ensured that no individual or entity could control or manipulate the flow of funds, providing a safe haven for those who valued their freedom above all else.

And so, armed with Bitcoin and a steadfast determination, Lily continued her fight for justice and equality, knowing that she had found a powerful ally in the battle against financial censorship. With Bitcoin by her side, she knew that no force in the world could silence the voice of truth and freedom.

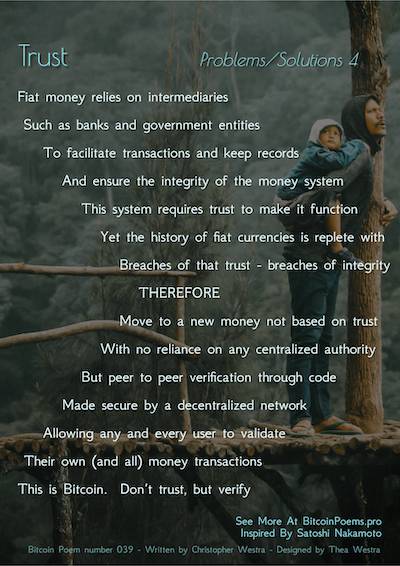

Problems and Solutions 4 - Trust

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 4 Poem (Trust) is Bitcoin Poem 039 – and was inspired by Satoshi Nakamoto

Fiat money relies on intermediaries

Such as banks and government entities

To facilitate transactions and keep records

And ensure the integrity of the money system

This system requires trust to make it function

Yet the history of fiat currencies is replete with

Breaches of that trust - breaches of integrity

Therefore

Let’s move to a new money not based on trust

With no reliance on any centralized authority

But peer to peer verification through code

Made secure by a decentralized network

Allowing any and every user to validate

Their own (and all) money transactions

This is Bitcoin. Don’t trust, but verify.

With fiat money, transactions are facilitated through banks and government entities, necessitating trust in these centralized authorities to maintain the integrity of the monetary system. However, this trust has often been betrayed throughout the history of fiat currencies, as Satoshi remarked in the Bitcoin White Paper, marked by breaches and instances of compromised integrity.

Bitcoin emerges as a transformative alternative, proposing a paradigm shift away from reliance on trust in centralized entities. The fundamental concept revolves around a decentralized network that operates on a peer-to-peer basis, cutting out the need for intermediaries. In this new monetary landscape, transactions are verified through code, and the security of the system is ensured by a decentralized network of nodes.

The call to “move to a new money not based on trust” reflects the ethos of Bitcoin, emphasizing the importance of verification over blind trust. By embracing a trustless system, users are empowered to validate their own transactions and contribute to the validation of the entire network. This trustless nature is encapsulated in the famous mantra associated with Bitcoin: “Don’t trust, but verify.” It encapsulates the philosophy that users can have confidence in the system not through blind trust but through the transparent and verifiable nature of blockchain technology.

In essence, Bitcoin represents a departure from the traditional financial model, offering a decentralized, transparent, and trustless framework that allows users to have greater control and verification over their financial transactions. This is a new era of financial autonomy and security.

Here is a story to illustrate.

“Don't Trust, Verify”: A Whisper that Revolutionized the Animal Kingdom

Once upon a time, in a lively forest where the sun always shone and the air was filled with the cheerful sounds of nature, there existed a grand clearing where animals from far and wide gathered to trade goods and services. At the heart of this bustling marketplace stood a majestic oak tree, its branches reaching skyward, a symbol of trust and integrity in the world of woodland commerce.

For generations, the creatures of the forest had placed their faith in the squirrels, who managed the treasures of the oak tree, entrusting them with their hard-earned acorns and relying on their guardianship to keep their wealth safe and secure. But as time passed, cracks began to appear in the facade of trust that had held the financial system together for so long.

Whispers of corruption and greed rustled through the leaves, tales of squirrels who hoarded acorns for themselves, and the foxes who manipulated the value of the forest's currency for their own gain. The once unshakable trust in the system began to falter, leaving the animals feeling vulnerable and exposed.

Amidst this uncertainty, a quiet revolution began to stir. A group of forward-thinking animals, led by a wise old owl, came together with a radical idea: to create a new form of currency that did not rely on trust in centralized authorities. They called it AcornCoin.

AcornCoin operated on a revolutionary concept known as the Treechain, a decentralized network of trees that verified and recorded transactions without the need for intermediaries like squirrels or foxes. Instead of placing blind faith in a central authority, users could verify the integrity of the system themselves, ensuring that every transaction was secure and transparent.

The mantra of this new monetary system was simple yet profound: “Don’t trust, but verify.” It encapsulated the philosophy that trust should not be blindly given but earned through transparency and verification.

As word spread of this groundbreaking innovation, animals from all walks of life flocked to embrace AcornCoin, drawn by its promise of financial autonomy and security. No longer did they have to rely on centralized institutions to safeguard their wealth; with AcornCoin, they could take control of their financial destinies and verify the integrity of every transaction themselves.

And so, in the grand marketplace of the forest, a new era of financial freedom dawned, fueled by the power of trustless technology and the unwavering belief that in a world of uncertainty, transparency and verification would always reign supreme.

Problems and Solutions 5 - Privacy

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 5 Poem (Privacy) is Bitcoin Poem 040 – and was inspired by Andreas Antonopoulos

Current money systems usually collect

Lots of personal information about users

This information can be vulnerable to hacks

And also identity theft, control, and censorship

Many people do not want sensitive personal

Information and documents stored online

Therefore

Since it’s not criminal to want some privacy

Let’s use a money system that doesn’t require

Personal information simply to use money

And doesn’t require submitting documents

Which remain on vulnerable databases

We have this money now, in Bitcoin

Bitcoin is a solution to financial privacy concerns. Here are some more specifics on how Bitcoin protects privacy:

Minimal Personal Information Requirement:

In traditional financial systems, individuals are often required to provide extensive personal information for transactions. This includes details such as names, addresses, and sometimes even social security numbers. Bitcoin transactions, on the other hand, do not require users to disclose their personal details. Bitcoin doesn’t care who uses the network, it can even be a computer, an alien, or a smart chimp.

Reduced Vulnerability to Hacks:

Traditional banking systems and online platforms storing personal information are susceptible to cyber attacks and hacks. Hackers know these centralized databases are “honeypots” of information. Bitcoin operates on a decentralized blockchain, making it more resistant to such attacks. The distributed nature of the blockchain ensures that there is no central point of failure, enhancing security.

Mitigation of Identity Theft:

The collection of extensive personal information in traditional systems can increase the risk of identity theft. Since Bitcoin transactions don't necessitate the disclosure of personal details, the potential for identity theft is significantly reduced.

Freedom from Centralized Control and Censorship:

Traditional financial systems are subject to centralized control, and authorities can impose censorship on transactions. Bitcoin operates on a decentralized network, providing users with more autonomy and preventing any single entity from controlling or censoring transactions.

User Preference for Privacy:

Many individuals are concerned about the storage of sensitive personal information online. Bitcoin, by design, allows users to maintain financial privacy without compromising security. This aligns with the preference of individuals who seek to keep their financial activities private.

Escape from “Criminalization of Privacy”:

Desiring financial privacy should not be considered a criminal act. Bitcoin allows users to conduct transactions without being subject to intrusive scrutiny, emphasizing the idea that privacy in financial matters is a basic right.

Absence of Document Submission:

Traditional financial transactions often require the submission of various documents, which are stored in centralized databases. Bitcoin transactions are document-free, eliminating the risk associated with storing sensitive information in vulnerable databases.

Here is a story to illustrate.

No More Prying Eyes! The Scurries Find Financial Freedom

Once upon a time, in a bustling town called Sunnyville, lived a family of squirrels – Papa Scurry, Mama Scurry, and their two energetic kits, Pip and Pop. Every week, Papa Scurry would visit the grand Hazelnut Bank to trade his hard-earned acorns for shiny hazelnuts.

At the bank, a grumpy badger named Mr. Ledger always asked Papa Scurry for mountains of documents – proof of address, nut-gathering permits, and even their family recipe for the best acorn pie! Pip and Pop found it strange. “Why does Mr. Ledger need to know everything about us?” they'd ask.

One day, a sly fox named Fibber overheard their conversation. “Aha! That information is valuable, little ones,” he cackled. “He uses it to track your every purchase and tell everyone what you buy!” Pip and Pop were worried. They didn't like the idea of Mr. Badger knowing all their acorn-spending secrets.

Then, one sunny afternoon, a wise old owl named Hootington visited the Scurries. He told them about a new system called “Bitcoin” where squirrels could trade acorns without showing any documents or revealing their names. Their transactions were recorded in a giant, public ledger called a “blockchain,” safe from sneaky foxes like Fibber.

Pip and Pop were amazed! No documents, no prying eyes! This was perfect. Papa Scurry was cautious at first, but he liked the idea of keeping his financial life private. Soon, more and more squirrels in Sunnyville started using Bitcoin. They appreciated the freedom and security it offered.

Mr. Ledger wasn't happy though. Fewer squirrels were visiting his Hazelnut Bank, and he couldn't track their purchases anymore. He grumbled and complained, but the squirrels knew they had a right to privacy.

Using Bitcoin, the Scurries could still buy all their favorite things without anyone knowing their business. Sunnyville became a place where squirrels had control over their own finances, and everyone lived happily ever after (with plenty of delicious acorns to share)!

Problems and Solutions 6 - Finality

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 6 Poem (Finality) is Bitcoin Poem 041 – and was inspired by TimeChainStats.com

Physical cash transactions are final

But in the digital world non-reversible

Transactions have not been possible

Since financial institutions cannot avoid

Mediating disputes which prevent finality

The cost of mediation slows enterprise

And makes trade and finance complex

Therefore

We need an electronic payment system

Based on cryptographic proof, not trust

Allowing any two parties to transact directly

With irreversible transactions based on a

Distributed timestamp server to generate

Proof of the chronology of the transactions

And thus finality. The solution is Bitcoin

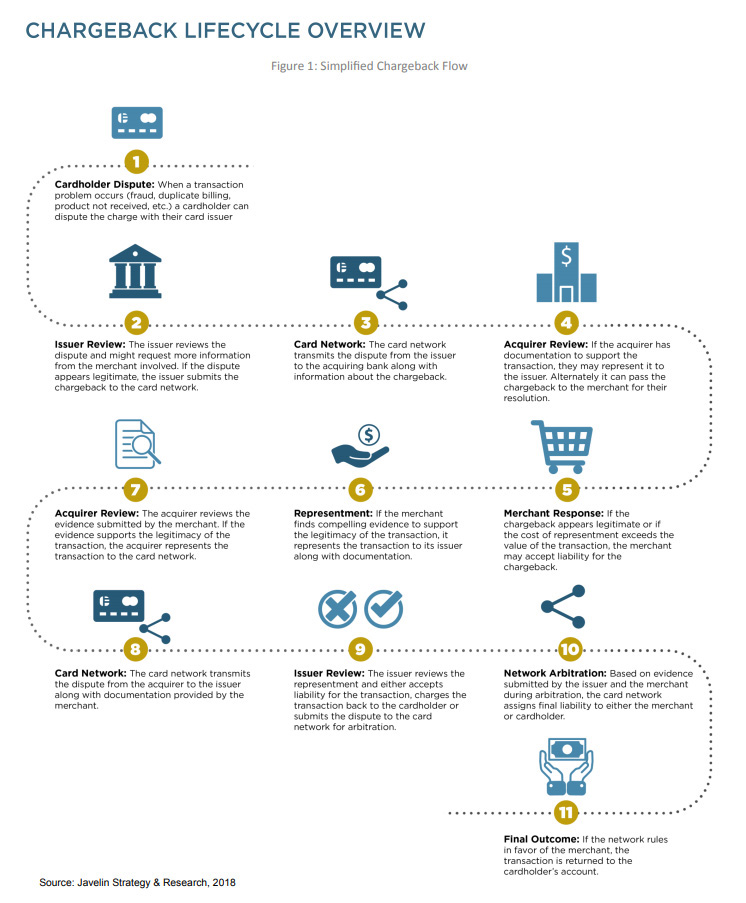

Chargebacks cost billions of dollars each year, and are mostly borne by the merchants.

The flowchart below shows the many steps required when non-final payments are disputed (sometimes frivolously).

Image above from Payment Cards and Mobile Website

While physical cash offers instant and irreversible finality, digital transactions have historically lacked this crucial element. Traditional financial institutions act as trusted intermediaries, settling disputes and mediating transactions, but at the cost of slowness, complexity, and fees.

Imagine the frictionless exchange of value, like handing over cash, but instantaneously across borders and without middlemen – that's the promise of Bitcoin's finality solution.

Through its ingenious design, Bitcoin eliminates the need for trust by relying on cryptographic proof, not promises or intermediaries. Every transaction is validated by the network of distributed miners, who compete to secure the network and earn the right to add new blocks to the blockchain.

Once a block is added, the transactions within it become cryptographically linked to all previous blocks, creating an immutable and publicly verifiable record. This distributed timestamp server ensures the irreversible chronology of transactions, guaranteeing unprecedented finality in the digital world.

No amount of dispute or manipulation can undo a confirmed Bitcoin transaction. This removes the need for slow and expensive mediations, simplifies international trade and finance, and opens up a world of faster, cheaper, and more secure financial interactions. With Bitcoin, finality becomes inherent in the system itself, a powerful testament to the transformative potential of cryptographic innovation.

Bitcoin not only streamlines trade and finance but also introduces a level of efficiency and transparency previously unattainable in the digital financial landscape.

The End of Disputes: How Bitcoin Secured a Baker's Business

Once upon a time, in a bustling town where the streets echoed with the chatter of merchants and the clinking of coins, there lived a humble baker named Thomas. Thomas prided himself on his freshly baked bread, which drew customers from far and wide.

One day, a traveler passing through the town stopped by Thomas's bakery and purchased a loaf of bread with a shiny gold coin. The transaction was swift and seamless, with Thomas handing over the bread and the traveler handing over the coin in return. In an instant, the exchange was complete, and both parties went on their way.

As Thomas watched the traveler disappear into the distance, he marveled at the simplicity and finality of the transaction. With physical cash, there was no need for intermediaries or disputes – the exchange was instant and irreversible, leaving no room for uncertainty.

But Thomas knew that in the digital world, transactions were not always so straightforward. Without the tangibility of physical cash, disputes could arise, and intermediaries were often needed to settle disagreements. This slowed down trade and commerce, making transactions complex and costly.

Determined to find a solution, Thomas turned to the world of Bitcoin. Bitcoin offered a revolutionary electronic payment system based on cryptographic proof, not trust. With Bitcoin, any two parties could transact directly, with irreversible transactions guaranteed by a distributed timestamp server.

Inspired by the promise of finality that Bitcoin offered, Thomas embraced the digital currency with open arms. No longer did he need to rely on intermediaries or worry about disputes – every Bitcoin transaction was cryptographically secured and immutable, ensuring that once a transaction was confirmed, it was final.

As Thomas continued to bake his bread and serve his customers, he marveled at the efficiency and simplicity of Bitcoin. With its innovative design, Bitcoin had transformed the world of digital transactions, ushering in a new era of finality and security.

And so, in a world where trust was often elusive and disputes were common, Bitcoin stood as a beacon of hope, offering a solution to the age-old problem of finality in the digital realm. With Bitcoin, transactions became not just efficient, but truly final – a testament to the power of cryptographic innovation.

Here is another little parable to further show the benefits of finality.

Captain Satoshi's Seashell Solution: Bringing Trust to Digital Transactions

In the bustling port city of Shimmer Bay, merchants bartered and traded using colorful seashells. Once a deal was struck, the shells were handed over, and the transaction was final. No take-backs, no arguments. But across the shimmering bay, a new city, Digiport, had sprung up. Here, transactions were conducted digitally, with promises whispered through glowing orbs.

However, these digital promises were far from final.

Merchants in Digiport often faced disputes. “The promised payment never arrived!” a disgruntled fishmonger would shout. The resolution process was slow and cumbersome, with wise elders spending days poring over records to determine the truth. Trade stagnated, held back by the uncertainty of unfinalized transactions.

One day, a curious sailor named Captain Satoshi arrived in Digiport. He spoke of a revolutionary system – a digital ledger maintained not by a single authority, but by everyone in the city. Each transaction was like a seashell, permanently etched into the ledger, visible to all.

No more broken promises, no more endless debates.

The merchants of Digiport were skeptical at first. Could a system without a central authority truly work? But Captain Satoshi explained how powerful computers called “miners” would compete to secure the ledger, adding new transactions and ensuring their finality. Once a transaction was etched into the ledger, it was set in stone, just like a seashell changing hands in Shimmer Bay.

Intrigued, the merchants of Digiport decided to give it a try. Soon, the city buzzed with activity. Transactions were completed swiftly and securely, without the need for slow and costly mediations. Trade flourished as merchants no longer feared the ghosts of unfulfilled promises.

The finality of Captain Satoshi's system, much like the finality of the seashells, brought trust and efficiency back to Digiport's digital marketplace.

And so, in a world where trust was often elusive and disputes were common, Bitcoin stood as a beacon of hope, offering a solution to the age-old problem of finality in the digital realm. With Bitcoin, transactions became not just efficient, but truly final – a testament to the power of cryptographic innovation.

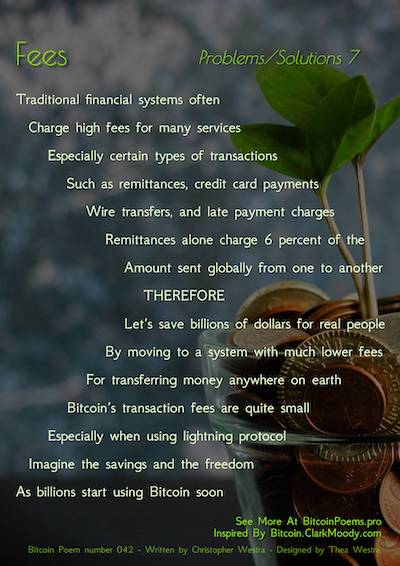

Problems and Solutions 7 - Fees

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 7 Poem (Fees) is Bitcoin Poem 042 – and was inspired by the Clark Moody Bitcoin Dashboard at Bitcoin.ClarkMoody.com

Traditional financial systems often

Charge high fees for many services

Especially certain types of transactions

Such as remittances, credit card payments

Wire transfers, and late payment charges

Remittances alone charge 6 percent of the

Amount sent globally from one to another

Therefore

Let’s save billions of dollars for real people

By moving to a system with much lower fees

For transferring money anywhere on earth

Bitcoin’s transaction fees are quite small

Especially when using lightning protocol

Imagine the savings and the freedom

As billions start using Bitcoin soon

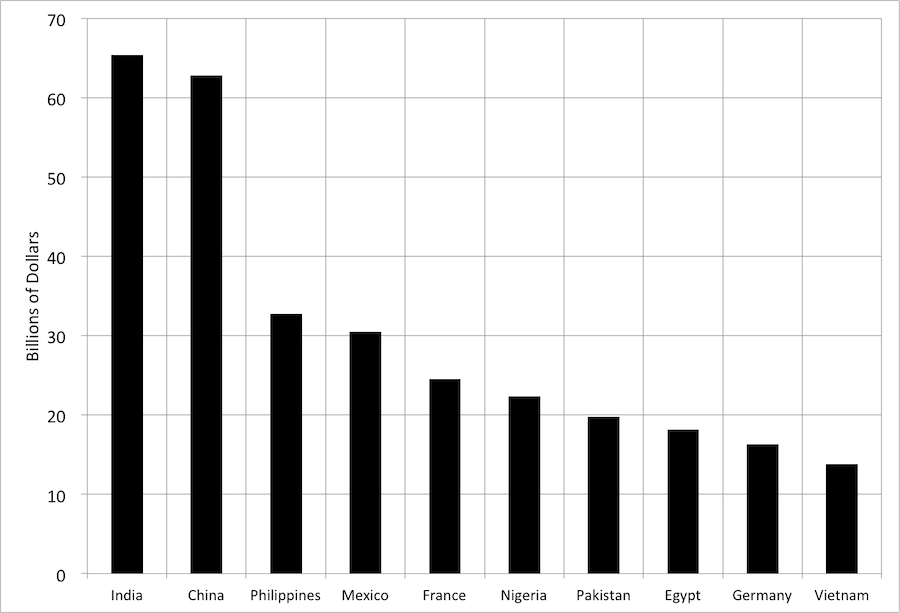

The Chart below shows the top 10 countries for inward remittances (Billions of Dollars - 2017).

The chart above is from the Money and Banking Website (ultimately sourced from the World Bank - 2017)

Bitcoin presents an opportunity to significantly reduce financial fees compared to traditional systems. With its decentralized nature and innovative technology, Bitcoin transactions typically incur lower fees, especially when utilizing protocols like the Lightning Network.

By leveraging Bitcoin for money transfers, individuals can potentially save substantial amounts of money, particularly on services like remittances, wire transfers, and credit card payments, where fees can be notably high.

This shift to Bitcoin has the potential to generate significant savings for users globally and promote greater financial inclusivity by reducing barriers to accessing affordable financial services.

Here is a little story to illustrate.

Anika's Tapestry and the Threads of Innovation: A Story of Bitcoin's Impact

In a bustling marketplace filled with colorful fabrics and fragrant spices, lived Anika, a weaver known for her beautiful tapestries. Each month, a portion of her earnings went to her family back in a distant village. Sending this money, called a remittance, was always a bittersweet affair.

While Anika wanted to support her loved ones, the fees charged by the money transfer service felt like a heavy tax on her hard work. 6% of every transaction seemed to vanish into thin air, leaving less for her family and a knot of frustration in Anika's stomach.

One day, a traveling merchant named Jafar arrived at the market. Jafar spoke of a new system, a digital currency called Bitcoin, that promised to change things. He explained that Bitcoin transactions were faster, more secure, and most importantly, much cheaper than traditional methods.

Anika was skeptical at first, but listened intently as Jafar described how Bitcoin's fees were minimal, especially when using something called the Lightning Network.

Intrigued, Anika decided to try it. Her first Bitcoin remittance was a revelation. The transaction was completed within minutes, and the fees were a fraction of what she usually paid. The joy of sending money to her family was amplified by the extra resources it left behind.

News of Anika's experience spread like wildfire through the marketplace. Soon, other vendors were trying Bitcoin for their own transactions. The marketplace buzzed with excitement as people discovered the freedom and savings offered by this new system. They could finally focus on their businesses and families, without a significant portion of their earnings disappearing into fees.

As more people embraced Bitcoin, the marketplace flourished. The money saved on transactions translated into new investments, vibrant stalls, and a sense of empowerment among the vendors. Anika, once burdened by fees, now used Bitcoin to not only support her family but also expand her weaving business.

The story of Anika and the marketplace is a glimpse into a future where financial systems work for the people, not the other way around. With Bitcoin, the power to move money around the world becomes faster, cheaper, and accessible to all.

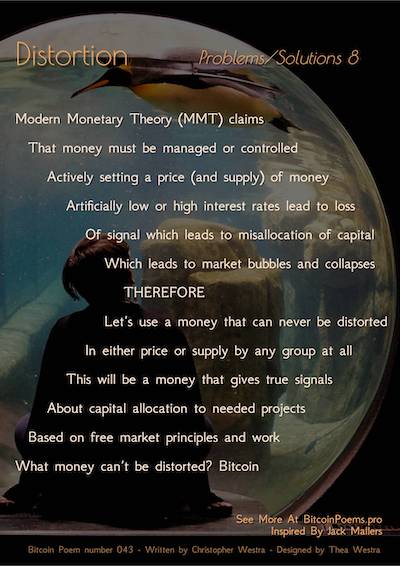

Problems and Solutions 8 - Distortion

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 8 Poem (Distortion) is Bitcoin Poem 043 – and was inspired by Jack Mallers

Modern Monetary Theory (MMT) claims

That money must be managed or controlled

Actively setting a price (and supply) of money.

Artificially low or high interest rates lead to loss

Of signal which leads to misallocation of capital

Which leads to market bubbles and collapses

Therefore

Let’s use a money that can never be distorted

In either price or supply by any group at all

This will be a money that gives true signals

About capital allocation to needed projects

Based on free market principles and work

What money can’t be distorted? Bitcoin

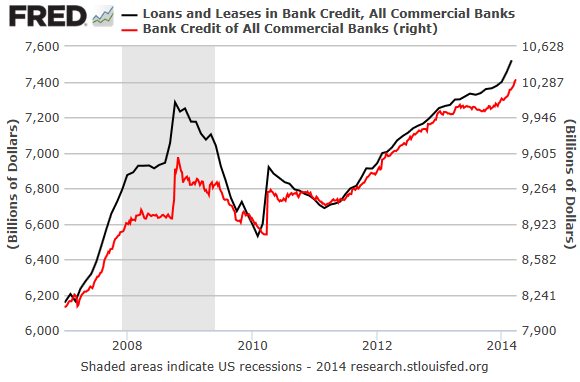

Chart showing the credit bubble of 2008/2009, and the subsequent financial crisis.

The chart above is from the Wolf Street Website, originally from the St. Louis Fed

Modern Monetary Theory (MMT), advocates for active management and control of currency, including the manipulation of interest rates to steer economic activity. However, critics argue that such interventions often lead to distortions in the market signals, resulting in misallocations of capital, market bubbles, and subsequent collapses.

A money system more immune to such manipulations would provide more accurate signals for capital allocation, promoting a healthier, more stable economic environment.

Bitcoin includes a decentralized ledger (and consensus) and fixed supply. Operating outside the influence of any central authority, Bitcoin's price and supply are determined mostly by market forces. This characteristic renders it resistant to manipulation and distortion, offering a potential solution to the shortcomings associated with traditional fiat currencies.

Advocates of Bitcoin hold it up as a means for true market signals to prevail, fostering a more transparent and efficient allocation of resources. In this vision, Bitcoin represents not only a currency but also a symbol of economic freedom and a beacon for those seeking to mitigate the distortions often inherent in centralized monetary systems.

Here is a story to illustrate:

Beyond the Tallykeeper's Reach: A Free Market Triumph in the Valley

In a valley nestled between snow-capped peaks lived two tribes: the Makers and the Takers. The Makers thrived on innovation and hard work. They built intricate tools, tilled fertile fields, and traded their goods with other valleys. Their currency was simple: clay tokens representing a day's labor.

The Takers, on the other hand, were ruled by the Grand Tallykeeper. He controlled a vast store of gold coins, the only currency accepted. The Tallykeeper believed his role was to actively manage the economy.

When harvests were bountiful, he'd declare the gold more valuable, making it harder for Makers to obtain loans for new tools. This, he claimed, prevented inflation. Conversely, during lean years, he'd flood the market with gold, making loans easier but risking a future price collapse.

This constant tinkering backfired. True signals of need were lost in the artificial ebb and flow of gold. The Makers, unsure of the future value of their labor, became hesitant to invest in long-term projects. Bubbles formed in short-term ventures, then burst, leaving a trail of wasted resources.

One Maker, a young woman named Elara, noticed a hidden valley rumored to hold a rare metal, Adamantine. Perfect for tools, Adamantine could revolutionize their work. But obtaining loans in the Taker's gold market was too risky for such a long-term venture.

Elara proposed a new system: time tokens. Each token represented a set amount of future labor, freely tradable amongst the Makers. With these tokens, Elara could secure investment from fellow Makers who believed in Adamantine's potential. The risk and reward were clear, based solely on the perceived value of the project, not the whims of the Grand Tallykeeper.

The time token system spread like wildfire. Innovation flourished. The discovery of Adamantine, funded by the free market, propelled the Makers into a golden age. The Takers, clinging to their gold and outdated system, watched with envy.

Elara's story became a legend, a testament to the power of a currency that reflected true value and empowered the people to allocate resources efficiently. It was a system based on work, not manipulation, a constant reminder that the best signal for an economy is the collective will of its makers.

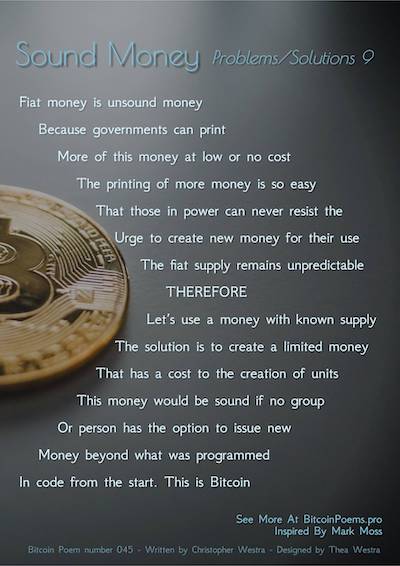

Problems and Solutions 9 - Sound Money

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 9 Poem (Sound Money) is Bitcoin Poem 045 – and was inspired by Mark Moss.

Fiat money is unsound money

Because governments can print

More of this money at low or no cost

The printing of more money is so easy

That those in power can never resist the

Urge to create new money for their use

The fiat supply remains unpredictable

Therefore

Let’s use a money with known supply

The solution is to create a limited money

That has a cost to the creation of units

This money would be sound if no group

Or person has the option to issue new

Money beyond what was programmed

In code from the start. This is Bitcoin

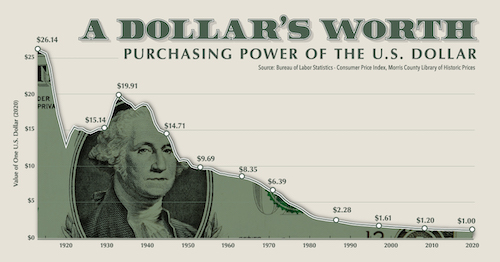

Fiat money, often criticized as unsound, derives its value from government decree rather than intrinsic worth. One of the primary criticisms of fiat currency lies in its susceptibility to manipulation, particularly through the process of money creation.

Governments possess the authority to print more money at relatively low or no cost, leading to an increase in the money supply. This ease of money creation can tempt those in power to pursue policies that prioritize short-term gains over long-term stability, resulting in inflation and economic uncertainty. The unpredictable nature of fiat money's supply undermines its credibility as a store of value and a medium of exchange.

In contrast, proponents of alternative monetary systems, such as Bitcoin, advocate for a more disciplined approach to money creation. Bitcoin operates on a decentralized network, governed by a predetermined set of rules embedded in its code. The supply of Bitcoin is limited, with a maximum cap of 21 million coins, ensuring scarcity akin to precious metals like gold.

Moreover, the creation of new Bitcoin units, known as mining, requires significant computational resources, introducing a cost to the process. This system of controlled supply and costly creation gives Bitcoin the characteristics of sound money, free from the whims of any central authority or government.

Advocates argue that Bitcoin's transparent and predictable monetary policy offers a more reliable foundation for economic transactions and long-term wealth preservation.

Here is a story to illustrate:

The Minters and the Programmers: A Tale of Two Currencies

In a bustling town nestled between rolling hills, there lived two groups of people: the Minters and the Programmers. The Minters, led by the Master Mint, controlled the production of coins in the town. They had the power to print more coins whenever they pleased, with little regard for the consequences.

On the other side of town, the Programmers, led by the Wise Coder, believed in a different approach to money. They saw the flaws in the Minter's system and advocated for a new kind of currency, one with a fixed supply and a cost to its creation.

The Master Mint, enamored by the allure of endless coins, often succumbed to the temptation to print more money. With each new coin minted, the value of the existing coins dwindled, leading to uncertainty and instability in the town's economy.

Meanwhile, the Wise Coder diligently worked on creating a digital currency called Bitcode. Bitcode was designed with a predetermined supply, much like a precious metal buried deep in the earth. The Wise Coder embedded strict rules in the code, ensuring that no one, not even the most powerful, could create more Bitcode beyond what was initially programmed.

As time passed, the flaws in the Minter's system became increasingly apparent. Inflation ran rampant, and the townsfolk grew weary of the ever-decreasing value of their coins. They longed for stability and predictability in their monetary system.

One day, the Wise Coder unveiled Bitcode to the townsfolk. They marveled at its elegance and simplicity, for it offered a solution to their woes. With its fixed supply and cost to creation, Bitcode provided a foundation of sound money that the town had never known.

Inspired by the promise of Bitcode, the townsfolk rallied behind the Wise Coder's vision. They embraced a new era of financial responsibility and stability, free from the whims of the Master Mint and his endless printing press.

As the sun set over the town, casting a warm glow upon its streets, the people knew that they had found a true solution to the problem of unsound money. And it all began with a few lines of code and a dream of a better future.

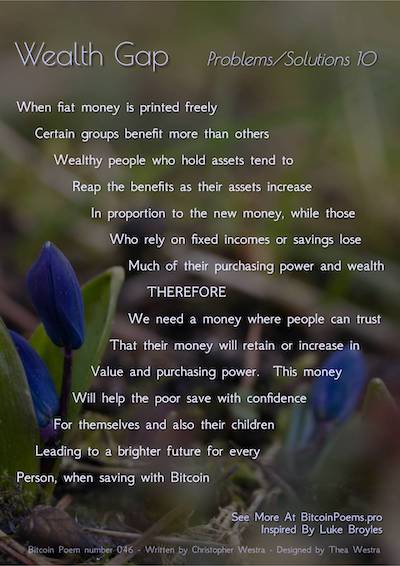

Problems and Solutions 10 - Wealth Gap

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 10 Poem (Sound Money) is Bitcoin Poem 046 – and was inspired by Luke Broyles.

When fiat money is printed freely

Certain groups benefit more than others

Wealthy people who hold assets tend to

Reap the benefits as their assets increase

In proportion to the new money, while those

Who rely on fixed incomes or savings lose

Much of their purchasing power and wealth

Therefore

We need a money where people can trust

That their money will retain or increase in

Value and purchasing power. This money

Will help the poor save with confidence

For themselves and also their children

Leading to a brighter future for every

Person, when saving with Bitcoin

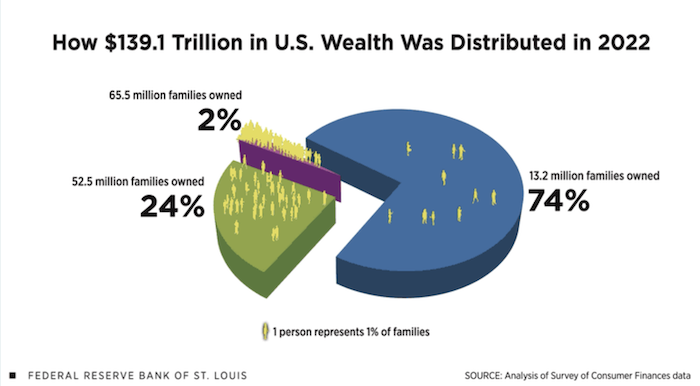

Image from the St. Louis Fed Website

In most countries we have a disparity perpetuated by the unrestricted printing of fiat money, where the wealthy thrive on the inflation of their assets while those dependent on fixed incomes or savings suffer the erosion of their wealth. Bitcoin provides a solution, offering a decentralized store of value that can restore trust in the stability and purchasing power of money.

With Bitcoin, individuals can save with confidence, knowing that their wealth won't be subject to arbitrary devaluation through inflation. This empowerment extends beyond the present generation, as the ability to save and accumulate wealth securely enables families to invest in the future prosperity of their children. By providing a reliable store of value, Bitcoin holds the promise of narrowing the wealth gap and fostering a more equitable society.

In embracing Bitcoin, individuals gain control over their financial destinies, free from the whims of centralized authorities. This shift towards a decentralized currency not only promotes financial inclusion but also lays the groundwork for a brighter and more equitable future for all.

As more people recognize the potential of Bitcoin to mitigate the wealth gap, its adoption could catalyze meaningful socioeconomic transformation, ushering in an era of prosperity and opportunity for generations to come.

Here is a story to illustrate:

Oakhaven's Golden Goose: A Fable About Inflation and Opportunity

In the bustling village of Oakhaven, nestled between rolling hills, lived two extended families: the Thriftys and the Earners. The Thriftys, wise and cautious, saved a portion of their earnings each year. Their savings were kept in clay jars, a symbol of their hard work and future security.

The Earners, a hardworking family, focused on putting food on the table and keeping a roof overhead. They had little left over to save, but their income was steady, allowing them to comfortably purchase the necessities.

One sunny morning, a royal decree arrived in Oakhaven. The King, facing a shortage of gold for his grand projects, announced the printing of more money!

The villagers rejoiced. More money meant more to spend, right?

However, the new money went to the King’s projects, and the special groups who bid for those projects. The newly printed money went to those already wealthy, and those who held the King’s favor.

So over time, a shadow crept in. The newly printed money, plentiful but not backed by anything of real value, began to lose its purchasing power. The same basket of vegetables that cost a few coins a month ago now required double the amount. The Thriftys realized their buying power had shrunk. Their clay jars, once overflowing with security, now held less value.

The Earners, reliant on their fixed income, were hit even harder. Their wages remained the same, but they could buy less and less with each passing month. Their dreams of saving for their children's education seemed to slip further away.

The King, oblivious to the suffering he caused, continued printing more money. The wealthy merchants, who owned land and other assets, saw their wealth increase proportionally to the new money. The gap between rich and poor widened.

One day, a young villager named Anya, known for her curiosity, returned from a faraway journey with tales of a strange new currency called Bitcoin. Unlike the King's ever-inflating money, Bitcoin had a limited supply, similar to precious metals. Its value was determined by trust and a complex system, not a royal decree.

Anya's stories sparked a new awakening in Oakhaven. People yearned for a currency they could trust, one that wouldn't erode their savings or widen the wealth gap. Slowly, the villagers began to understand Bitcoin's potential. It offered a glimmer of hope, a chance to save with confidence and build a brighter future, not just for themselves but for their children.

The story of Oakhaven serves as a cautionary tale about the dangers of unbacked fiat money and the potential of Bitcoin to create a more equitable system. With a limited and predictable supply, Bitcoin empowers individuals to take control of their financial destinies and build a future where saving isn't a gamble, but a path towards prosperity.

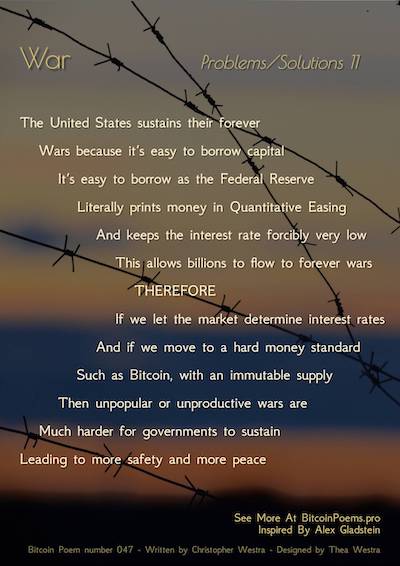

Problems and Solutions 11 - War

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 11 Poem (War) is Bitcoin Poem 047 – and was inspired by Alex Gladstein.

The United States sustains their forever

Wars because it’s easy to borrow capital

It’s easy to borrow as the Federal Reserve

Literally prints money in Quantitative Easing

And keeps the interest rate forcibly very low

This allows billions to flow to forever wars

Therefore

If we let the market determine interest rates

And if we move to a hard money standard

Such as Bitcoin, with an immutable supply

Then unpopular or unproductive wars are

Much harder for governments to sustain

Leading to more safety and more peace

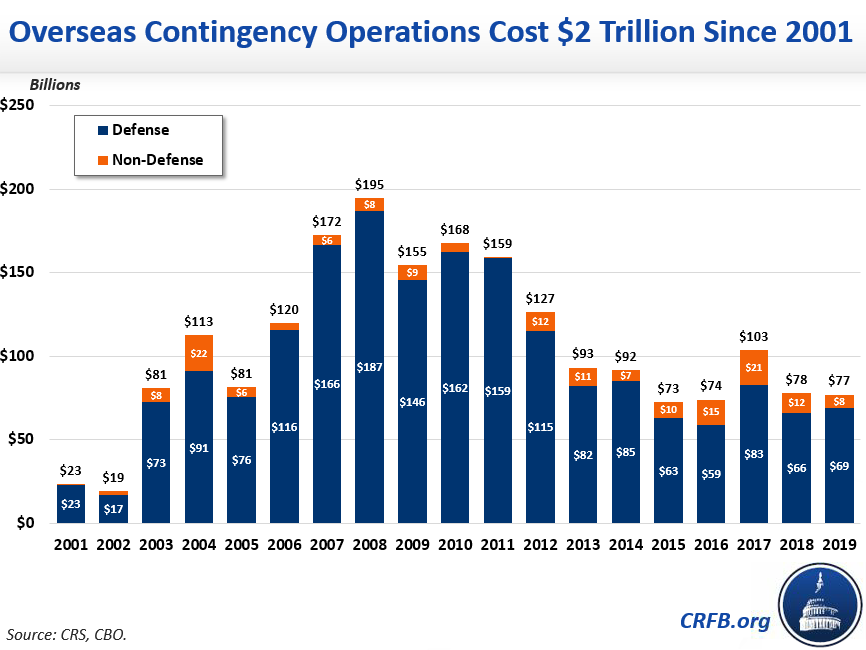

The chart below shows overseas "operations" from 2001 to 2019.

Chart above is from the Committee for a Responsible Federal Budget Website

Under the current system, central banks like the Federal Reserve can implement policies such as quantitative easing and artificially low interest rates to inject liquidity into the economy, making it easier for governments to borrow money for military endeavors. This easy access to capital, combined with the lack of fiscal discipline, has enabled governments to engage in unpopular or unproductive wars for extended periods.

Transitioning to a hard money standard, where the supply of currency is fixed and determined by market forces rather than centralized institutions, could significantly alter this dynamic. In such a system, governments would no longer have the ability to simply print money or manipulate interest rates to fund their military ventures.

Instead, they would be constrained by the finite supply of money and subject to the discipline of market-driven interest rates.

By removing the ability of governments to finance wars through inflationary measures and easy borrowing, a hard money standard can make unpopular or unproductive wars economically unsustainable.

Without the ability to simply create money out of thin air, governments would be forced to rely on direct taxation or budget reallocations to fund military endeavors, making it much more difficult to sustain prolonged conflicts.

In this way, a hard money standard has the potential to promote peace and security by limiting the financial resources available for warfare. By aligning economic incentives with the pursuit of peace, such a system could help foster a more stable and harmonious international order, where conflicts are resolved through diplomacy and negotiation rather than military force.

Here is a story to illustrate:

The Echoes of War: A Cautionary Tale of Inflation and Conflict

In a bustling village nestled between rolling hills, life was peaceful for a time. The villagers, known for their craftsmanship and resourcefulness, thrived through trade and cooperation. However, a shadow loomed on the horizon. A neighboring village, fueled by whispers of an endless wellspring of gold, began to stir trouble.

This neighboring village had a peculiar system. Instead of using coins minted from precious metals like the one the craftsmen used, they relied on “promise notes.” These notes were issued by a central well, and their value hinged on the promise that more notes could be created whenever needed.

Tempted by the allure of easy wealth, the neighboring village embarked on an ambitious campaign of expansion. They hired foreign fighters, built grand fortifications, and financed it all with a constant flow of new promise notes.

At first, the craftsmen's village prospered further. The demand for their goods from the expanding neighbor was high. But a disquieting trend emerged. As more and more notes were printed, each one seemed to buy less. The price of simple goods began to climb, and whispers of discontent rose amongst the villagers.

The elders, wise and cautious, knew the dangers of such a system. With each new promise note, the real value of the existing ones dwindled. It was like a never-ending well that, instead of water, produced a shimmering illusion of wealth.

One day, a young apprentice named Lance returned from a trade mission to the neighboring village. His eyes were wide with worry. “They're planning a war,” he reported, “and they're counting on their endless notes to finance it.”

The elders knew they had to act. They gathered the villagers and explained the precarious situation. “Their war may bring them temporary gain,” they warned, “but the cost will be borne by everyone, through ever-rising prices and a dwindling supply of true value.”

The villagers, valuing their peaceful lives and hard-earned wealth, decided to take a stand. They proposed a new system, with new monetary units based on work, their value derived from the metal they were made of. Since this metal was hard to obtain, this “hard money,” as they called it, wouldn't be subject to inflation or manipulation.

The neighboring village scoffed at their proposal. But as time passed, the cracks in their own system began to show. The war they financed dragged on, their promise notes grew worthless, and their people faced shortages and hardship.

The craftsmen's village, on the other hand, thrived. Their hard money system instilled trust and stability. They continued to trade, innovate, and invest in their future, knowing the value of their resources wouldn't be eroded by endless printing of new notes.

The story of the two villages became a cautionary tale. It showed that while easy credit might create the illusion of wealth, it ultimately led to instability and conflict. True prosperity, the villagers learned, came from hard work, resourcefulness, and a system based on honest value, not endless promises.

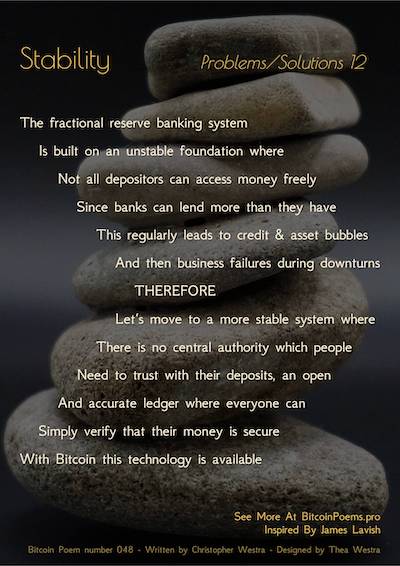

Problems and Solutions 12 - Stability

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 12 Poem (Stability) is Bitcoin Poem 048 – and was inspired by James Lavish.

The fractional reserve banking system

Is built on an unstable foundation where

Not all depositors can access money freely.

Since banks can lend more than they have

This regularly leads to credit & asset bubbles

And then business failures during downturns

Therefore

Let’s move to a more stable system where

There is no central authority which people

Need to trust with their deposits, an open

And accurate ledger where everyone can

Simply verify that their money is secure

With Bitcoin this technology is available

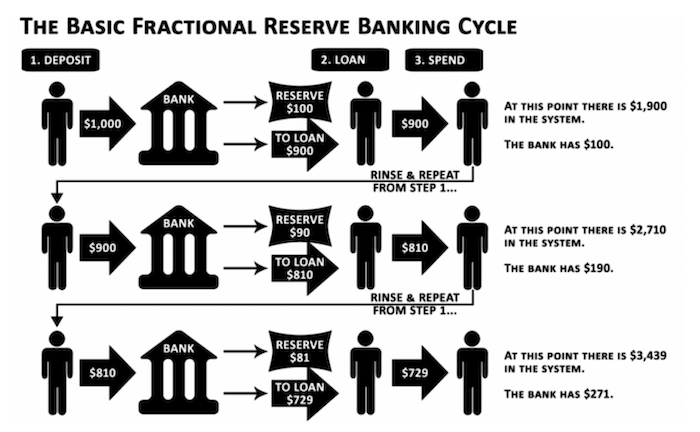

Image taken from the Research Gate website

In the fractional reserve system, banks are allowed to lend out more money than they actually hold in reserves, leading to a situation where not all depositors can access their funds simultaneously. This inherent instability can result in credit and asset bubbles, as well as systemic failures during economic downturns, as witnessed in various financial crises throughout history.

Moving towards a system of full reserve banking, where banks are required to hold 100% of their deposits in reserve, offers a solution to this instability. By ensuring that all depositors have immediate access to their funds, the risk of bank runs and financial panics is greatly reduced.

This stability is further reinforced by the adoption of a hard money standard, such as Bitcoin, where the money supply is fixed and not subject to manipulation by central authorities.

Bitcoin's decentralized and transparent ledger provides security and integrity of financial transactions without the need for a central authority. Every transaction on the Bitcoin network is recorded on the blockchain and verified by a network of decentralized nodes, making it virtually impossible to manipulate or counterfeit.

By leveraging the technology underlying Bitcoin, individuals can have confidence that their money is secure and accessible at all times. The open and accurate ledger allows for anyone to verify the integrity of their transactions, eliminating the need to trust a central authority with their deposits. This increased transparency and security pave the way for a more stable financial system, free from the boom-and-bust cycles that plague traditional fractional reserve banking.

In conclusion, transitioning to a system of full reserve banking coupled with a hard money standard like Bitcoin offers the potential for greater stability and security in the financial system. By eliminating the risks associated with fractional reserve banking and central authority control, individuals can have greater confidence in the safety and accessibility of their money, leading to a more resilient and sustainable economy.

Here is a story to illustrate:

From Opaque to Open: How Honeycomb Creek Found Security in Transparency

In the bustling town of Honeycomb Creek, life revolved around the sweet, golden honey produced by its hard working bees. Every bee diligently collected nectar, depositing their honey in the town's grand Honey Bank, a towering structure managed by Mr. Buzzworthy, a portly bee known for his booming voice and even larger promises.

Mr. Buzzworthy ran the Honey Bank on a system he called “fractional honey reserves.” He explained to the bees that while they deposited their honey, he could safely lend out a portion to others, like the industrious ants who needed honey to fuel their construction projects. This, he claimed, allowed the town to grow even richer.

At first, everything seemed fine. The bees happily deposited their honey, and the ants buzzed with activity as their projects flourished. But whispers began to spread as the bees noticed something peculiar. When a small group of bees needed some honey for the upcoming winter, Mr. Buzzworthy seemed hesitant. “There's been a temporary shortage,” he mumbled, “but don't worry, your honey is safe!”

Unease settled over Honeycomb Creek. More and more bees found it difficult to access their honey when they needed it most. Frustration grew, and rumors swirled that Mr. Buzzworthy's “temporary shortages” were more frequent than he let on.

One day, a young, tech-savvy bee named Beatrice stumbled upon an intriguing idea buzzing around the web. It was called a “honeycomb ledger,” a digital record of every honey deposit and withdrawal, completely transparent and accessible to everyone. Beatrice excitedly presented this concept to the town council.

The council, weary of Mr. Buzzworthy's opaque system, saw great promise in the honeycomb ledger. With this technology, every bee could verify their own honey reserves, eliminating the need to trust Mr. Buzzworthy entirely. Additionally, the ledger's fixed supply, mirroring the limited honey production, would prevent the inflation that had plagued the town under the fractional reserve system.

The townspeople embraced the new system. They built a secure digital network maintained by a swarm of volunteer bees, ensuring the ledger's integrity. Now, every bee could see exactly how much honey was in the collective pot, and which specific pieces of honey, or honeycrisps, were their own, fostering trust and transparency.

Honeycomb Creek thrived under the new system. The bees worked hard, knowing their honey was safe and accessible. The ants continued their construction projects, confident in a stable honey supply. The town, once riddled with anxieties about “missing honeycrisps,” buzzed with a newfound sense of security and economic harmony.

The story of Honeycomb Creek became a beacon for other towns struggling with unreliable financial systems. It demonstrated the power of a transparent and secure ledger, free from the pitfalls of fractional reserves and centralized control.

And so, the bees of Honeycomb Creek, through their innovative spirit and a little bit of digital magic, paved the way for a more stable and prosperous future.

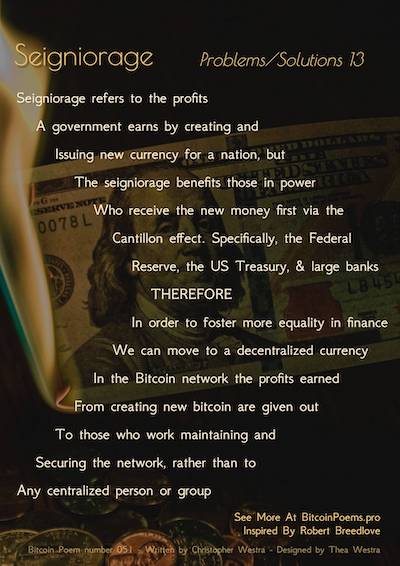

Problems and Solutions 13 - Seigniorage

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 13 Poem (Seigniorage) is Bitcoin Poem 051 – and was inspired by Robert Breedlove.

Seigniorage refers to the profits

A government earns by creating and

Issuing new currency for a nation, but

The seigniorage benefits those in power

Who receive the new money first via the

Cantillon effect. Specifically, the Federal

Reserve, the US Treasury, & large banks

Therefore

In order to foster more equality in finance

We can move to a decentralized currency

In the Bitcoin network the profits earned

From creating new bitcoin are given out

To those who work maintaining and

Securing the network, rather than to

Any centralized person or group

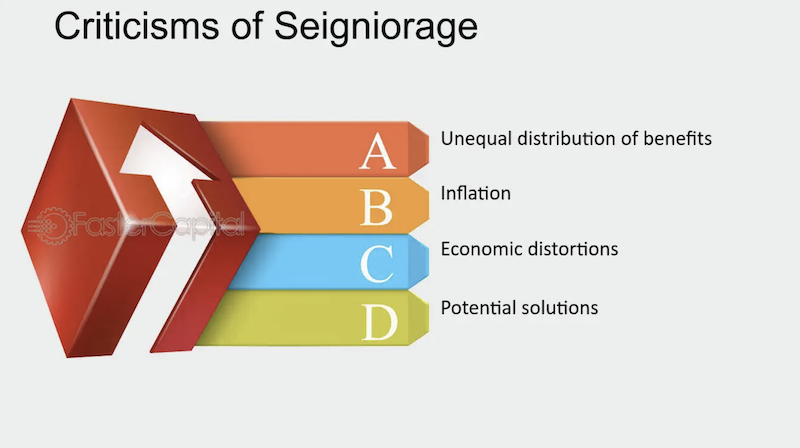

Image is from the Faster Capital Website

The Faster Capital Website has an amazing step by step article on seigniorage, and you can learn a lot by reading it. You can learn the WHY and HOW of seigniorage, the role of Central banks, and all the drawbacks. You can read this Faster Capital Article Here.

Bitcoin has the potential to promote equity in finance by eliminating the concept of seigniorage. Seignorage refers to the profits generated by a government through the creation and issuance of new currency.

In traditional monetary systems, seigniorage benefits those in positions of power, such as central banks, treasuries, and large financial institutions, who receive the newly created money first through the Cantillon effect.

This unequal distribution of seigniorage exacerbates economic inequality by disproportionately enriching those already in privileged positions.

However, with Bitcoin's decentralized nature, seigniorage is fundamentally altered. Instead of benefiting a select few, the profits earned from creating new bitcoins are distributed to individuals who contribute to the maintenance and security of the network. This process, known as mining, involves using computational power to validate and record transactions on the blockchain.

By rewarding miners with newly created bitcoins, rather than centralizing profits in the hands of a privileged few, Bitcoin fosters a more equitable distribution of wealth within the financial ecosystem.

Bitcoin's model of distributing seigniorage rewards to network participants democratizes the process of wealth creation in finance. By removing the reliance on centralized authorities and empowering individuals to participate in the network, Bitcoin promotes a more inclusive and fair financial system where wealth is generated through merit and contribution rather than inherited privilege or access to power.

This shift towards decentralization has the potential to reduce systemic inequalities and promote greater economic empowerment for individuals across the globe.

Here is a short parable to illustrate:

The Shards of Hope: A Kingdom's Journey from Inflation to Equity

In the heart of a vast kingdom, a life-giving river snaked its way through fertile fields and bustling towns. The river was the lifeblood of the land, its waters carefully managed by a council of wise Riverkeepers. These benevolent rulers ensured fair distribution of the water, nurturing a society where prosperity was shared by all.

One day, a cunning advisor named Viscount Venal approached the Riverkeepers. “Why rely solely on the river's flow?” he whispered. “We can create more wealth by printing new golden seeds, representing the river's future bounty.”

Intrigued, the Riverkeepers agreed. Viscount Venal, with a sly grin, flooded the land with these golden seeds. Merchants received them first, using them to buy more goods and inflate prices. The wealthy elite, close to the source of the new seeds, grew richer.

But as the golden seeds trickled down to the commoners, their value dwindled. Farmers struggled to buy basic necessities, and whispers of discontent filled the air. The Riverkeepers, realizing their mistake, saw the rich growing richer while the poor grew poorer.

A young boy named Kiran, known for his curiosity, discovered a hidden valley nestled within the kingdom. There, a community thrived using a unique system. Their wealth wasn't based on printed promises, but on “River Shards” – rare, beautiful stones mined from the riverbed.

Kiran learned that anyone could participate in mining these River Shards. All they needed was hard work and ingenuity to solve the complex puzzles that secured the network. Rewards for successful mining came in the form of newly discovered River Shards, fairly distributed to those who contributed to the river's health.

Returning to the kingdom, Kiran shared his discovery. The Riverkeepers, impressed by the fairness and sustainability of the River Shard system, saw a path to correcting their mistake. They embraced the new system, dismantling the printing of golden seeds.

The kingdom witnessed a transformation. As people participated in mining River Shards, wealth became more evenly distributed. Farmers used earned Shards to improve their lands, merchants offered fair prices, and a sense of shared prosperity returned.

The story of the Riverkeepers and the River Shards became a beacon of hope. It showed that true wealth wasn't created through manipulation and privilege, but through hard work, collaboration, and a system that rewarded everyone who contributed to the collective good.

The kingdom flourished, a testament to the power of a fair and decentralized system where everyone could benefit from the river's bounty.

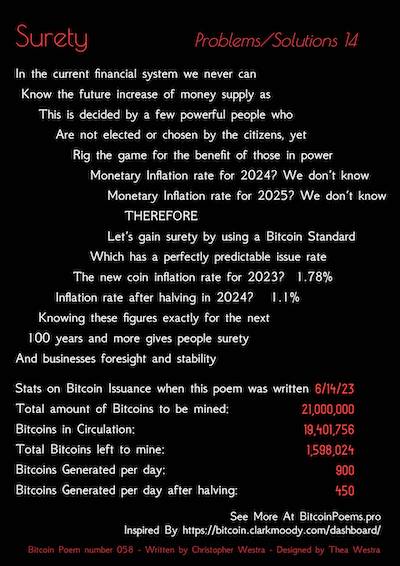

Problems and Solutions 14 - Surety

You can see this full size poem on a background here.

Here is a small version.

In the larger set of Bitcoin Poems, this Problem 14 Poem (Surety) is Bitcoin Poem 058 – and was inspired by Clark Moody’s Bitcoin Dashboard.

In the current financial system we never can

Know the future increase of money supply as

This is decided by a few powerful people who

Are not elected or chosen by the citizens, yet

Rig the game for the benefit of those in power

Monetary Inflation rate for 2024? We don’t know

Monetary Inflation rate for 2025? We don’t know

Therefore

Let’s gain surety by using a Bitcoin Standard

Which has a perfectly predictable issue rate

The new coin inflation rate for 2023? 1.78%

Inflation rate after halving in 2024? 1.1%

Knowing these figures exactly for the next

100 years and more gives people surety

And businesses foresight and stability

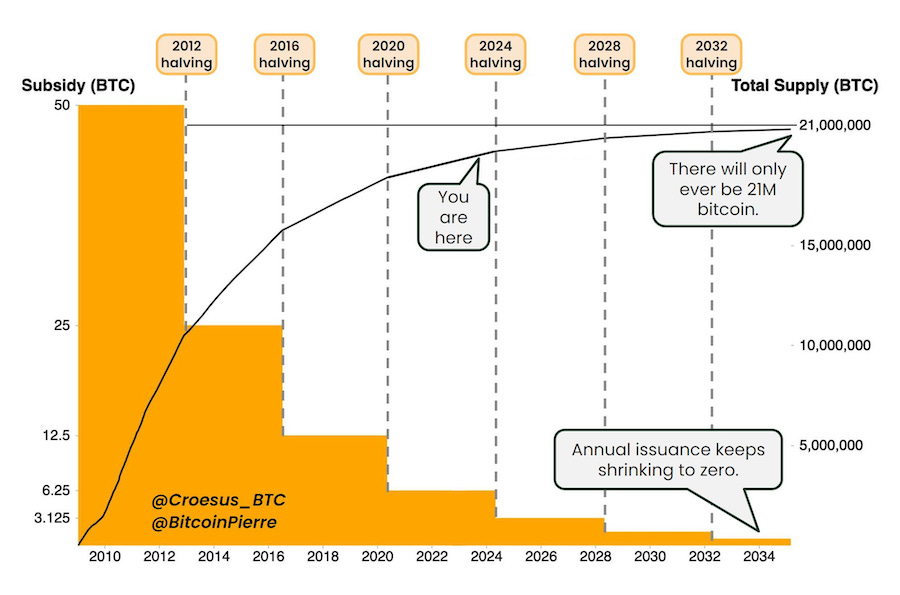

Here's a chart showing the predictable issuance of new bitcoin over the years.

The chart above is from the Once in a Species Website

Bitcoin's predictable supply is a big advantage because it gives people more certainty for planning their lives. Unlike traditional money, where a few people decide how much money gets made, Bitcoin works differently. With Bitcoin, the amount of new coins created is set by an algorithm that everyone can see. No one person or group can change this to benefit themselves.

In our current money system, decisions about how much new money to make are made by officials who are not elected, and their choices can be influenced by their own interests. This lack of transparency and control can make people feel unsure and distrustful.

But with Bitcoin, things are clear. The rate at which new Bitcoins are created is known in advance and is open for everyone to see. This means that people and businesses can plan for the future with confidence, knowing exactly how much new Bitcoin will be made each year.